Payroll Services

P.A.S. Payroll Solutions a division of Professional Administrative Specialists, Inc. offers a complete online payroll and tax service targeted at getting you out of payroll processing and back to running your business. At P.A.S. Payroll Solutions we know that no one method is right for everyone. This is why we provide you with a variety of payroll input options. Whether you prefer to call in your payroll to our specialists, send in your information via fax, email or text or enter the data online with an internet-based solution you can be confident that your data is safe and secure. With P.A.S. Payroll Services, you can have it your way:

Choose your schedule: Weekly, Bi Weekly or Monthly

Process payroll via: Email or Internet, Telephone, Fax or Text

Distribute payroll via: Direct Deposit, Live Checks Ready for Signature, Pre Signed Live Checks

Receive Checks via: Ready to Print PDF File, Electronic Import, Hand Delivery, Mail or Overnight Delivery

P.A.S. Payroll Solutions offers direct deposit or professionally printed checks for your employees. Funding for payroll and taxes can be done through payroll impounding or paid directly from your own account. Here's how it works:

1. Each payday, just provide us with employee hours and we’ll take care of the rest. We provide:

• Direct deposit with detailed pay stubs

• Support for a wide range of pay types

• Sick, vacation and holiday pay accurals

• Federal, state and local tax calculations

• Voluntary deduction calculations

• Paycheck printing

• Online employee access to pay stubs

• Contractor payments

• Multi-state payroll

• 100% accuracy guaranteed

2. We handle all your federal and state taxes. You never have to worry about upcoming tax obligations . . . we take care of everything, including:

• Federal Tax Deposits

• Quarterly 941s

• Annual 940s and 944s

• Employee W-2s

• 1099-MISC Filing

• State Tax Deposits

• Quarterly State Tax Forms

• Annual State Tax Forms

3. We provide easy-to-read reports. You'll get easy-to-understand detailed reports so you will always be current on payroll information. Our detailed reports include:

• Paycheck Details |

• Payroll Summary |

• Deductions and Contributions |

• Worker's Compensation |

• Employee Details |

• Vacation and Sick Leave |

• Contractor Details |

• Billing Summary |

• Tax Liability |

• Total Cost |

• Tax and Wages |

• Retirement Plans |

• Tax Payments |

• Contractor Payments |

Additional Payroll Options

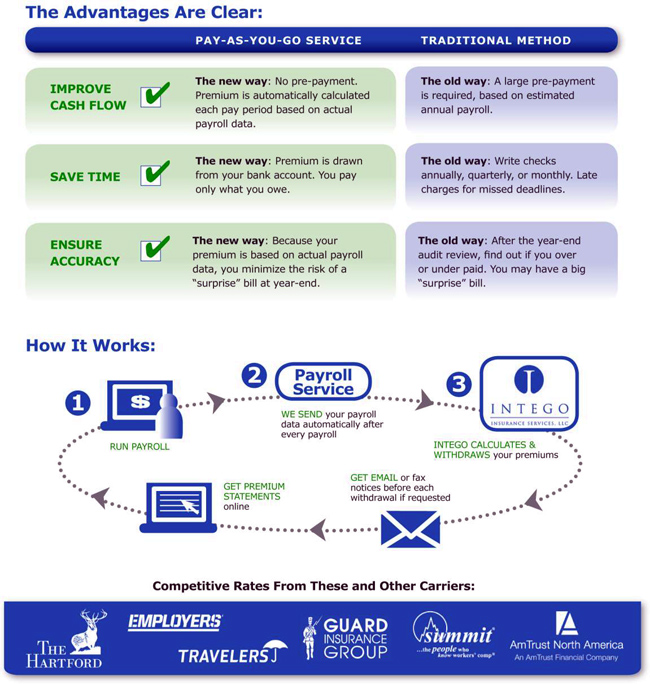

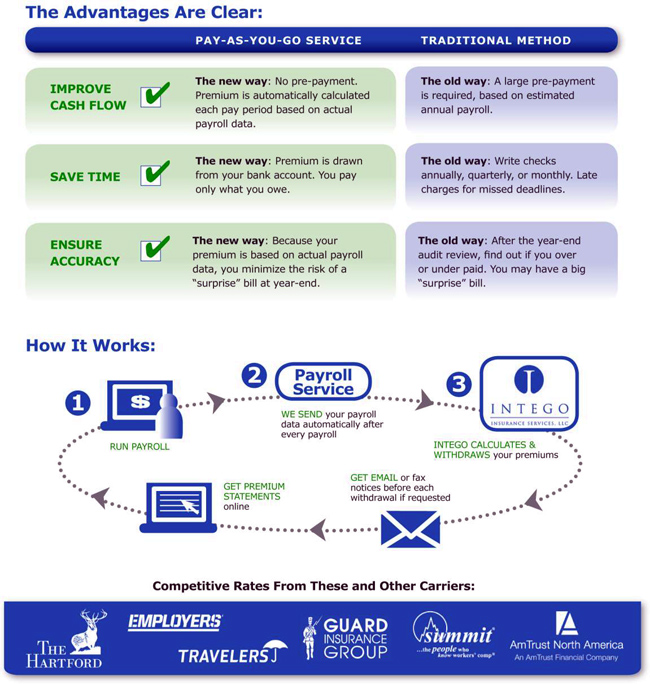

Workers' Compenstation Pay-As-you-Go. Pay worker's compensation premiums automatically each payday with our Pay-As-You-Go service powered by Intego Insurance Services. Each payment is based on your actual payroll for the period. Because Intego works with a variety of carriers, you get competitive rates and the convenience of a one-stop shop.

Automatic Time Tracking — Save Time and Reduce Errors! Save time and reduce costly errors by allowing your employees to track their own hours online and eliminate double input. It can be time consuming n to track employee hours and re-enter the data, especially when you have to follow complicated overtime rules.

• Reduce costly errors by automatically calculating total hours worked (including overtime)

• Reduce compliance risks by applying state and federal overtime and double time rules

• Save valuable time eliminating double input by allowing employees to enter their own hours online

• Fully integrated with payroll so you never have to calculate or re-enter hours

• Easily review and adjust hours to fix employee mistakes

• Automatic Email Reminders to employees when timesheets are due

• Password-protected online timesheets website and/or multi-user online timeclock where employees can clock in

and out

Other Services.

• 1099 Contractor Direct Deposit Payments

• Annual 1099/1096 Preparation and Filing

• 401K and Cafeteria Routine Deductions

• Data Export Directly Into QuickBooks File

|